Insurance is a vital component of

modern life, providing financial security and peace of mind in the face of unforeseen

events. In this article, we will delve into the world of insurance, starting

with its fundamental definition and moving on to how it operates. We'll also

explore the main types of insurance policies available to individuals and

businesses.

I. Understanding Insurance

·

Defining

Insurance

Insurance is a contract between

an individual or entity (the insured) and an insurance company (the insurer).

The insured pays regular premiums to the insurer in exchange for protection

against specific risks, with the insurer promising to provide financial support

when these risks materialize.

·

The Role

of Risk

Insurance is fundamentally about

managing risk. It allows individuals and organizations to transfer the

financial burden of unexpected events to the insurer. These events could

include accidents, illnesses, property damage, or liability claims.

II. How Insurance Works

·

The

Premiums and Coverage

Insured individuals or entities

pay premiums, usually on a regular basis (monthly, quarterly, or annually). The

amount of the premium is determined by various factors, including the type and

level of coverage, the insured's risk profile, and the insurer's underwriting

process.

·

Policy

Terms and Conditions

Insurance policies come with

specific terms and conditions that outline what is covered, what is excluded,

and any limitations. It's essential for policyholders to thoroughly understand

these terms to ensure they have the coverage they need.

·

Claim

Process

When an insured event occurs, the

policyholder files a claim with the insurance company. The insurer then

assesses the claim and, if it meets the policy's terms and conditions, provides

financial assistance to the policyholder.

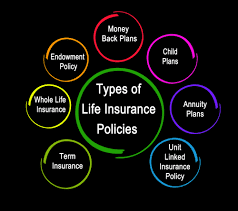

III. Main Types of Insurance Policies

·

Life

Insurance

Life insurance provides a

financial benefit to beneficiaries upon the policyholder's death. It can be a

term life policy that lasts for a specified period or a permanent policy that

covers the insured's lifetime.

·

Health

Insurance

·

Auto

Insurance

Homeowners or Renters Insurance

Homeowners and renter’s insurance

policies protect against property damage, theft, and liability. Homeowners'

insurance covers the structure and contents of the home, while renter’s

insurance covers personal belongings in a rented property.

Business Insurance

Business insurance encompasses a

range of policies tailored to protect companies and their assets. This includes

commercial property insurance, liability insurance, workers' compensation, and

more.

Conclusion

Insurance plays a crucial role in

our lives, providing a safety net for unforeseen events that could otherwise

lead to significant financial burdens. By understanding the basics of

insurance, how it operates, and the main types of policies available,

individuals and businesses can make informed decisions to protect their

financial well-being and mitigate risk.

.png)